Cenovus Energy: Refining Snags Test Investor Nerves as Oil Sands Giant Resets for 2025

26.12.2025 - 13:39:05Cenovus Energy has spent most of 2024 proving that scale and integration can shield an oil sands producer from volatile crude prices. But a string of refining headaches this autumn has reminded investors that downstream resilience can cut both ways, knocking the stock off its highs even as oil sands production and cash returns stay robust.

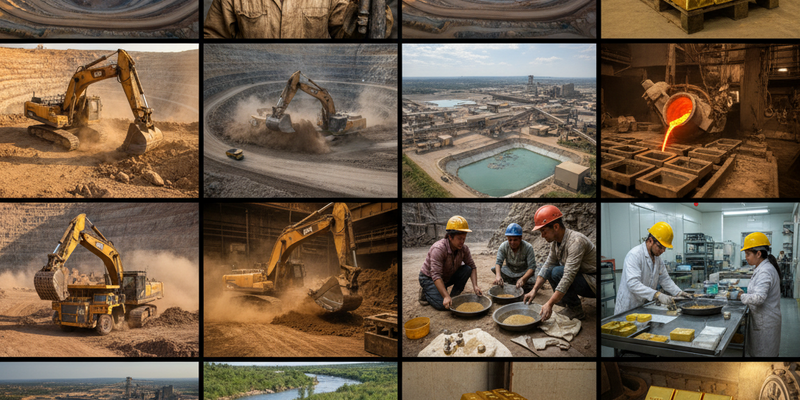

Cenovus Energy Aktie: integrated oil sands player at a discount

One-Year Investment Performance

As of late December 2025, Cenovus Energy trades around the mid?C$20s on the Toronto Stock Exchange, modestly below its 52?week peak near the high?C$20s but still comfortably above its 12?month trough in the high?teens. Over the past five trading days the stock has drifted sideways to slightly lower, mirroring softer crude benchmarks and lingering unease about refining reliability. Zooming out, the 90?day tape tells a different story: after a strong run into late summer on the back of firmer oil prices and solid oil sands volumes, Cenovus has been consolidating those gains in a broad, choppy range.

For investors who bought a year ago, the ride has ultimately been rewarding. Cenovus shares are up by a double?digit percentage in that period—roughly mid?teens in total return terms when dividends are included—outpacing many global integrated peers. The precise figure depends on the entry point, but an investor who stepped in around last December’s levels would today be sitting on a gain comfortably north of 10%, even after the recent pullback driven by downstream outages.

Recent Catalysts and Market Momentum

The biggest swing factor for Cenovus over the past week has been refining. In a December update, the company disclosed unplanned outages and reliability issues at several U.S. refineries, including its stake in the Toledo facility. Those snags forced Cenovus to trim its full?year downstream throughput guidance and flag narrower refining margins for the closing quarter of the year. The market reaction was swift: the stock sold off on the day of the announcement as investors recalibrated earnings expectations and questioned the pace of Cenovus’s post?acquisition integration of U.S. refining assets.

Yet the refining setbacks come against a backdrop of operational strength in the company’s core oil sands business. Cenovus has reiterated that production at its Christina Lake and Foster Creek projects remains on track, and it continues to drive incremental efficiency gains across its thermal portfolio. With oil sands output running steadily and Western Canadian Select differentials relatively well?behaved thanks to improved egress, the upstream engine is still humming. That upstream resilience has tempered the share price damage from refining issues and helped keep the one?year performance solidly positive.

Strategically, Cenovus has also pressed ahead on debt reduction and shareholder returns through 2024. Net debt has moved toward the company’s targeted range, unlocking room for higher variable returns of capital. Regular dividends have been topped up by share buybacks when market conditions allow, a pattern that has underpinned investor confidence even as quarterly results have been buffeted by refining volatility. In the past week, trading volumes have been elevated around guidance updates, suggesting portfolio managers are actively re?balancing rather than abandoning the name.

Financial Verdict & Wall Street Ratings

On the Street, Cenovus still enjoys a broadly favourable verdict. Over the past month, Canadian energy desks at major banks—including RBC Capital Markets, TD Securities, BMO Capital Markets and Scotiabank—have maintained their bias toward positive recommendations, generally clustering around “Outperform” or “Sector Perform” rather than outright Sells. Price targets, while trimmed at the margin to factor in weaker near?term refining cash flow, still imply meaningful upside from current trading levels, with many analysts anchoring their valuation on mid?cycle oil prices and normalized downstream margins.

Several recent notes have drawn a clear distinction between transient operational noise and structural value. RBC and TD have highlighted Cenovus’s leverage to heavy crude and its integrated model as reasons to stay patient, arguing that once refining reliability improves, the market will refocus on free?cash?flow yield and balance sheet strength. BMO and Scotiabank, for their part, have pointed to Cenovus’s discount to both Canadian integrated peers and U.S. refiners, suggesting that the current share price already embeds a heavy haircut for operational risk. Across the board, the tone is more “proceed with caution” than “head for the exits.”

Future Prospects and Strategy

Looking ahead to 2025, Cenovus’s investment case hinges on two levers: unlocking the full potential of its refining system and continuing to grind down costs in the oil sands. Management has already signalled that reliability projects and maintenance scheduling will be front and centre in the downstream portfolio, with a clear goal of smoothing cash flows and reducing the probability of the kind of outages that rattled the stock this year. If those efforts bear fruit, Cenovus’s integrated structure—long seen as a strategic shield against pricing shocks—could again be a source of multiple expansion rather than investor anxiety.

On the upstream side, Cenovus is poised to benefit from incremental capacity additions and modest debottlenecking at core oil sands assets, without the heavy capital burden of megaprojects. That positions the company to convert a larger share of operating cash into shareholder returns, especially if crude prices remain firm and Canadian pipeline egress continues to improve. For long?term investors who can tolerate operational bumps, the recent pullback may prove to be another entry point into a name that couples scale, integration and a still?undemanding valuation. The next few quarters of execution—particularly in refining—will determine whether Cenovus finally earns the premium rating its size and asset base arguably deserve.